Some Known Incorrect Statements About Pacific Prime

Some Known Incorrect Statements About Pacific Prime

Blog Article

How Pacific Prime can Save You Time, Stress, and Money.

Table of ContentsThe smart Trick of Pacific Prime That Nobody is Talking AboutHow Pacific Prime can Save You Time, Stress, and Money.The Best Guide To Pacific PrimeSome Of Pacific PrimeTop Guidelines Of Pacific Prime

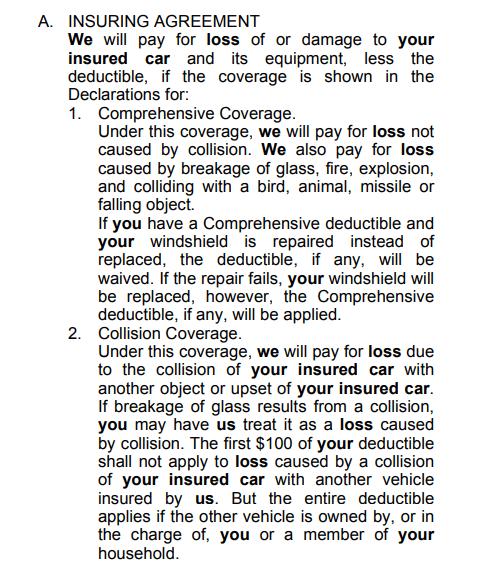

Insurance coverage is a contract, stood for by a policy, in which an insurance policy holder receives financial defense or compensation versus losses from an insurance coverage firm. Most people have some insurance policy: for their cars and truck, their home, their healthcare, or their life.Insurance policy likewise helps cover costs related to obligation (lawful duty) for damage or injury triggered to a 3rd party. Insurance is an agreement (plan) in which an insurance firm indemnifies an additional versus losses from particular backups or perils. There are several sorts of insurance coverage. Life, wellness, house owners, and auto are among the most typical forms of insurance.

Investopedia/ Daniel Fishel Many insurance plan types are offered, and virtually any private or service can discover an insurance provider ready to guarantee themfor a rate. Common individual insurance coverage plan kinds are vehicle, health, homeowners, and life insurance coverage. A lot of people in the USA contend the very least one of these sorts of insurance policy, and vehicle insurance policy is called for by state regulation.

Some Known Details About Pacific Prime

Discovering the rate that is appropriate for you requires some legwork. The plan restriction is the maximum amount an insurance firm will pay for a protected loss under a plan. Maximums may be established per period (e.g., annual or policy term), per loss or injury, or over the life of the policy, likewise understood as the life time maximum.

There are several various types of insurance. Wellness insurance coverage helps covers regular and emergency clinical care prices, usually with the alternative to add vision and oral services independently.

Nevertheless, many precautionary services might be covered for complimentary before these are satisfied. Health insurance policy might be bought from an insurer, an insurance agent, the government Medical insurance Marketplace, given by an employer, or federal Medicare and Medicaid protection. The federal government no more calls for Americans to have health and wellness insurance policy, but in some states, such as California, you might pay a tax fine if you don't have insurance policy.

Pacific Prime for Dummies

The firm then pays all or many of the protected expenses linked with a vehicle crash or various other car damages. If you have a leased car or obtained money to purchase an auto, your lending institution or leasing dealer will likely need you to bring automobile insurance policy.

A life insurance policy policy warranties that the insurance provider pays a sum of cash to your recipients (such as a spouse or youngsters) if you die. In exchange, you pay costs during your life time. There are two major types of life insurance policy. Term life insurance policy covers you for a particular duration, such as 10 to two decades.

Irreversible life insurance policy covers your entire life as long as you proceed paying the premiums. Traveling insurance covers the costs and losses connected with traveling, including trip cancellations or delays, insurance coverage for emergency situation health care, injuries and emptyings, harmed luggage, rental automobiles, and rental homes. Nonetheless, also some of the finest traveling insurer - https://pacificpr1me.blog.ss-blog.jp/2024-04-03?1712088442 do not cover terminations or hold-ups because of weather, terrorism, or a pandemic. Insurance is a method to handle your economic risks. When you purchase insurance coverage, you acquire security versus unexpected economic losses.

Pacific Prime for Dummies

There are several insurance plan types, some of the most common are life, health, property owners, and auto. The appropriate sort get redirected here of insurance coverage for you will depend on your objectives and economic circumstance.

Have you ever before had a moment while looking at your insurance coverage or buying insurance coverage when you've believed, "What is insurance coverage? And do I really require it?" You're not alone. Insurance can be a mysterious and confusing point. How does insurance job? What are the advantages of insurance coverage? And how do you discover the most effective insurance policy for you? These prevail questions, and the good news is, there are some easy-to-understand responses for them.

Nobody wants something poor to happen to them. Suffering a loss without insurance policy can put you in a tough financial circumstance. Insurance is a crucial financial device. It can help you live life with fewer worries understanding you'll get financial support after a disaster or crash, aiding you recuperate quicker.

Some Known Details About Pacific Prime

And in many cases, like car insurance and employees' compensation, you may be required by regulation to have insurance coverage in order to shield others - global health insurance. Discover ourInsurance choices Insurance policy is basically a massive wet day fund shared by several people (called insurance policy holders) and handled by an insurance policy provider. The insurance coverage firm uses cash gathered (called premium) from its insurance holders and various other investments to pay for its procedures and to satisfy its promise to insurance holders when they sue

Report this page